The Growing Role of Companies in Blended Finance

According to a recent survey of the market for blended finance, companies play a critical role in the three largest categories of blended finance transactions:

- company-level blended transactions

- project-level blended finance

- blended finance funds

Source: Convergence

Company-level blended transactions

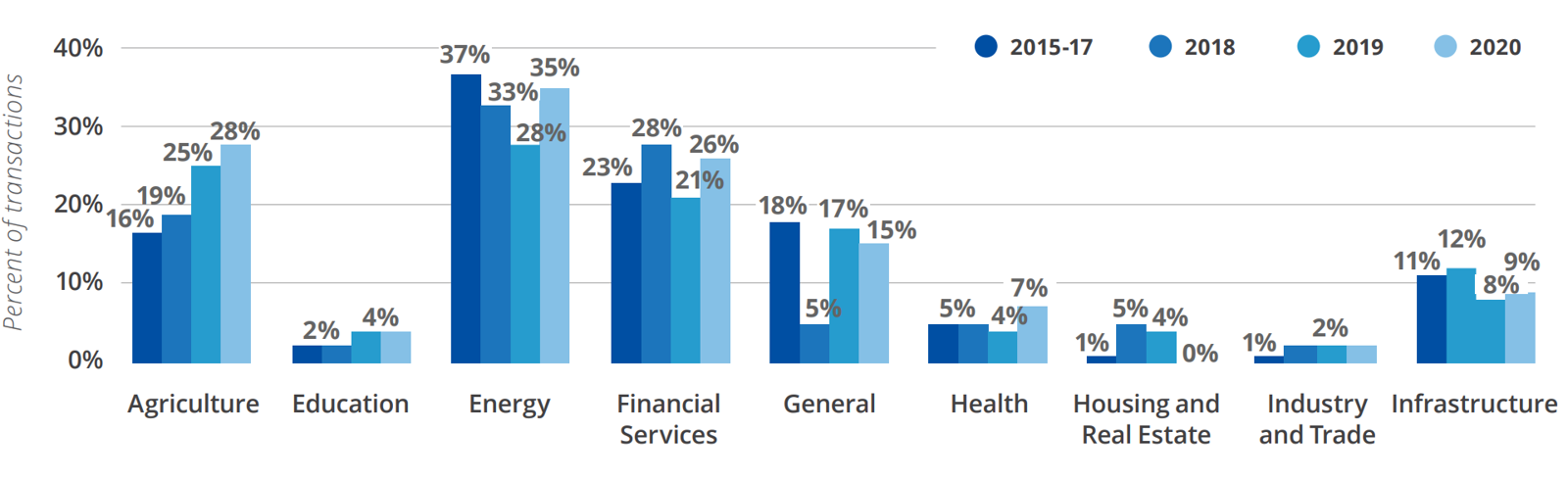

Company-level blended transactions have grown steadily during the past few years to become the most prevalent type of vehicle for blended finance. While the transaction size remains lower than project-level blended finance, according to Convergence, the median size of transactions also doubled in 2020 to $20 million. The role of companies as a vehicle for blended finance is particularly important in some sectors of the economy, such as agriculture.

Source: Convergence

Project-Level Blended Finance

Projects use the blended-finance structure with the largest median transaction size ($130 million). Corporations are key to project-level blended finance as sponsors, partners, or off-takers.

Fund-level Blended Finance

According to Convergence, “funds continue to represent the largest share of blended finance transactions, with private equity vehicles in particular gaining notable traction since 2018. Private equity and venture capital ecosystems in emerging markets are in turn driving greater capital flows to more blended finance companies.”

Corporate Structure as a Credible Vehicle to Scale Blended Finance

The deployment of blended finance through private companies and banks – or corporate blended finance – can be an effective way to increase the credibility and scale of blended finance. Corporate intermediation provides multiple benefits in terms of management, governance and transparency, including:

- sophisticated management and governance systems, including those for the management of environmental and social impacts

- disclosure and transparency, especially for publicly listed companies

- the ability to issue liquid investment products (equity, bonds)

- a track record of providing innovative and profitable solutions for sustainability

In addition, profit motivations ensure that companies and private banks favor solutions that will become commercially viable after a period of experimentation, and therefore scalable. Support from the public sector, therefore, is only temporary and focuses on mechanisms that can be replicated and scaled.

The hope is that, over time, insurance and guarantees provided by development finance institutions and impact investors would be replicated privately and scaled through commercial banks or financial institutions.

Traditionally, de-risking solutions have been provided through public-private partnerships in which a public institution -- sovereign state or development finance institution (DFI) -- provides a guarantee or concessionary capital to reduce the risks of a project and attract private investors. More recently, de-risking solutions have also been provided as blended capital, with contributions from philanthropic foundations or impact investors who are willing to accept lower risk-adjusted returns in exchange for impact. In comparison with private financial institutions, however, states, development banks, foundations, and impact investors are limited in the amount of capital they can deploy to guarantee or otherwise de-risk a project. To scale the market, the participation of private financial institutions is necessary as shown in the example of a successful transition from DFI funding to private capital in Chile (see Resource).

The Link with Foreign Direct Investment (FDI)

Blended corporate finance can help support the role of companies and banks as critical sources of financing for the SDGs in emerging markets.

The link between blended, or subsidized, finance and FDI is highlighted in the 2030 Agenda for Sustainable Development and the Addis Ababa Action Agenda on financing for development. Paragraph 45 of the latter reads: